Loading Netspend with a credit card is a convenient way to add funds to your account. It can be done online, over the phone, or at a retail location. To load Netspend with a credit card online, you will need to log in to your Netspend account and select the "Add Funds" option. Then, select the "Credit Card" option and enter your credit card information. You can also load Netspend with a credit card over the phone by calling Netspend's customer service number. To load Netspend with a credit card at a retail location, you will need to bring your Netspend card and credit card to the store. The cashier will then scan your Netspend card and process the transaction.

There are several benefits to loading Netspend with a credit card. First, it is a convenient way to add funds to your account. Second, it can help you build your credit history. Third, it can give you access to rewards and benefits that are not available to cash users.

However, there are also some risks to consider when loading Netspend with a credit card. First, you may be charged a fee for the transaction. Second, if you do not pay off your credit card balance in full each month, you may be charged interest on the amount you borrowed. Third, using a credit card to load Netspend can lead to overspending.

How to Load Netspend with Credit Card

Loading Netspend with a credit card is a convenient and widely used method to add funds to your Netspend account. Understanding the key aspects of this process is essential for efficient and effective use of this service.

- Convenience: Loading Netspend with a credit card can be done online, over the phone, or at retail locations, offering flexibility and ease of use.

- Fees: Depending on the method chosen, there may be associated fees for loading Netspend with a credit card. It's important to consider these fees before selecting a loading option.

- Limits: Netspend may impose limits on the amount that can be loaded onto your account using a credit card. These limits vary based on factors such as your account type and creditworthiness.

- Credit Building: Regularly loading Netspend with a credit card and paying off the balance on time can contribute to building a positive credit history.

- Rewards: Some credit cards offer rewards or cash back when used to load Netspend. Utilizing these cards can provide additional benefits.

- Security: When loading Netspend with a credit card, ensure that you are using a secure and reputable platform to protect your sensitive financial information.

In conclusion, loading Netspend with a credit card involves various key aspects that impact the convenience, cost, limits, and potential benefits associated with this process. By understanding these aspects, you can make informed decisions when choosing the best loading method for your specific needs and circumstances. It's also crucial to consider factors such as fees, limits, and security measures to ensure a smooth and secure loading experience.

1. Convenience

The convenience of loading Netspend with a credit card is a key factor contributing to its widespread adoption. The ability to add funds to your Netspend account through multiple channels, including online, over the phone, and at retail locations, provides users with unmatched flexibility and ease of use.

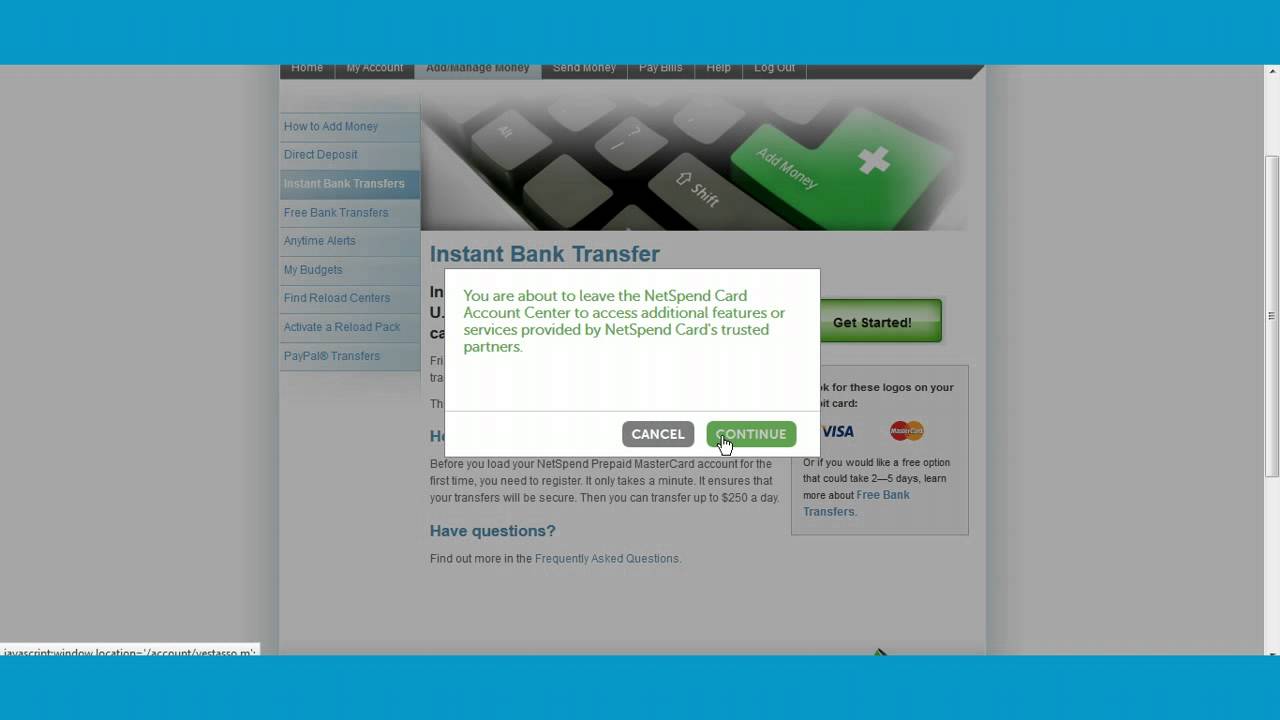

Online loading offers the convenience of managing your account from anywhere with an internet connection. You can simply log in to your Netspend account, select the "Add Funds" option, and follow the prompts to load funds using your credit card. This method is particularly useful when you need to add funds quickly and easily.

Loading Netspend with a credit card over the phone is another convenient option, especially if you do not have access to the internet or prefer to speak to a customer service representative. Simply call Netspend's customer service number, provide your account information, and follow the instructions to load funds using your credit card.

For those who prefer in-person transactions, loading Netspend with a credit card at a retail location is a convenient and accessible option. You can visit any authorized Netspend reload center, such as Walmart or CVS, and present your Netspend card and credit card to the cashier. The cashier will scan your Netspend card and process the transaction, adding funds to your account.

The convenience of loading Netspend with a credit card is particularly beneficial for individuals who may not have access to traditional banking services or who prefer the flexibility of using a credit card. It allows them to manage their finances and access their funds easily and efficiently, contributing to their overall financial well-being.

2. Fees

Understanding the fees associated with loading Netspend with a credit card is a critical aspect of using this service effectively. These fees can vary depending on the loading method chosen and can impact the overall cost of adding funds to your account.

When loading Netspend with a credit card online, there is typically a fee of $4.95 per transaction. This fee is charged by Netspend and is non-refundable. However, some credit card issuers may offer rewards or cash back for using their cards to load Netspend, which can offset the cost of the fee.

Loading Netspend with a credit card over the phone or at a retail location may also incur fees. These fees vary depending on the specific location or service provider. For example, loading Netspend with a credit card at a Walmart MoneyCenter incurs a fee of $3.00 per transaction.

It's important to compare the fees associated with different loading methods before selecting an option. This will help you minimize the overall cost of adding funds to your Netspend account. Additionally, consider any potential rewards or benefits offered by your credit card issuer for using their card to load Netspend.

By understanding the fees involved in loading Netspend with a credit card, you can make informed decisions about the best loading method for your needs and circumstances.

3. Limits

Understanding the limits associated with loading Netspend using a credit card is crucial for effective account management. Netspend may impose limits on the amount you can load onto your account due to various factors, including your account type, creditworthiness, and regulatory requirements.

- Account Type: Different Netspend account types may have varying limits on the amount that can be loaded using a credit card. Basic accounts typically have lower limits compared to premium or business accounts.

- Creditworthiness: Your creditworthiness plays a significant role in determining the limits imposed on your Netspend account. Individuals with a strong credit history and high credit score may be eligible for higher loading limits.

- Regulatory Requirements: Netspend, as a financial institution, must comply with regulatory requirements aimed at preventing fraud and money laundering. These requirements may impose limits on the amount that can be loaded onto your account using a credit card.

Knowing the limits associated with loading Netspend using a credit card will help you plan your financial transactions effectively. If you encounter any issues or have questions regarding the limits, it's recommended to contact Netspend's customer service for assistance.

4. Credit Building

The connection between credit building and loading Netspend with a credit card lies in the responsible use of credit. By consistently adding funds to your Netspend account using a credit card and making timely payments to clear the balance, you demonstrate positive credit behavior. This behavior is recorded in your credit report, which is a detailed history of your credit activities. A positive credit history indicates to lenders that you are a reliable borrower, which can lead to improved credit scores and access to better financial products and services.

Regularly loading Netspend with a credit card and paying off the balance on time shows lenders that you can manage credit responsibly. It helps establish a pattern of consistent and timely payments, which is a key factor in calculating credit scores. Over time, this positive credit behavior can contribute to building a strong credit history, increasing your overall creditworthiness.

In conclusion, understanding the connection between credit building and loading Netspend with a credit card is essential for effective financial management. By using your credit card responsibly and making timely payments, you can harness this opportunity to build a positive credit history, which can have long-term benefits for your financial well-being.

5. Rewards

Loading Netspend with a credit card can provide additional benefits beyond the convenience and flexibility it offers. Certain credit cards offer rewards or cash back when used to load Netspend, providing users with an opportunity to earn rewards on their everyday financial transactions.

- Earning Rewards and Cash Back: By using a credit card that offers rewards or cash back when loading Netspend, users can accumulate points, miles, or cash that can be redeemed for various rewards, such as travel, gift cards, or statement credits. This provides an additional incentive to use a credit card for Netspend loading, effectively turning everyday transactions into opportunities to earn rewards.

- Maximizing Rewards Potential: To maximize the rewards earned from loading Netspend with a credit card, users should consider the specific rewards programs offered by different credit card issuers. Some cards offer higher rewards rates for certain categories of spending, such as gas, groceries, or travel. By aligning the rewards program with their spending habits, users can optimize their rewards earnings.

- Choosing the Right Credit Card: Not all credit cards offer rewards or cash back for loading Netspend. Therefore, it's important to research and compare different credit card options to find one that aligns with individual needs and spending patterns. Factors to consider include the rewards rate, annual fees, and other benefits offered by the card.

- Responsible Credit Card Use: It's crucial to use credit cards responsibly when loading Netspend to avoid potential financial pitfalls. This includes paying off credit card balances in full and on time to avoid interest charges and maintain a good credit score.

In conclusion, understanding the connection between rewards and loading Netspend with a credit card can provide users with additional benefits and incentives. By choosing the right credit card and using it responsibly, users can earn rewards on their everyday financial transactions, maximizing the value they get from their Netspend account.

6. Security

Security plays a crucial role when loading Netspend with a credit card. Protecting sensitive financial information is paramount to safeguard against unauthorized access and potential fraud. Using a secure and reputable platform is essential to ensure the confidentiality and integrity of your personal and financial data.

- Secure Platform: Loading Netspend with a credit card should only be done through authorized and secure platforms. Avoid using public Wi-Fi networks or untrusted websites, as they may be vulnerable to interception or data breaches. Legitimate platforms will implement robust security measures, such as encryption and fraud detection systems, to protect your information.

- Reputable Provider: Choose to load Netspend with a credit card through reputable and well-established providers. These providers have a proven track record of maintaining high security standards and adhering to industry best practices. Verifying the legitimacy of the platform, checking online reviews, and seeking recommendations can help you identify reputable providers.

- Data Protection: When loading Netspend with a credit card, ensure that the platform employs strong data protection measures. Look for platforms that use encryption technologies to safeguard your personal and financial information during transmission and storage. Additionally, check if the platform has a clear privacy policy outlining how your data will be used and protected.

- Fraud Prevention: Reputable platforms will have fraud prevention mechanisms in place to detect and prevent unauthorized transactions. These measures may include address verification systems, CVV code verification, and transaction monitoring. By utilizing these safeguards, the platform can minimize the risk of fraudulent activities and protect your financial well-being.

By adhering to these security measures, you can safeguard your sensitive financial information when loading Netspend with a credit card. Using secure platforms, choosing reputable providers, and being vigilant about data protection and fraud prevention practices empowers you to conduct financial transactions with confidence and minimize the risks associated with online transactions.

FAQs

This section provides answers to frequently asked questions about loading Netspend with a credit card, addressing common concerns and misconceptions.

Question 1: What are the benefits of loading Netspend with a credit card?Loading Netspend with a credit card offers several benefits, including convenience, potential rewards, and the ability to build credit. It provides a convenient way to add funds to your Netspend account, and some credit cards offer rewards or cash back for these transactions.

Question 2: Are there any fees associated with loading Netspend with a credit card?Yes, there may be fees associated with loading Netspend with a credit card, depending on the method used. Online loading typically incurs a fee, while fees for over-the-phone or in-person loading may vary. It's important to compare fees and choose the most cost-effective option.

Question 3: Are there limits on the amount I can load onto my Netspend account using a credit card?Yes, Netspend may impose limits on the amount you can load onto your account using a credit card. These limits vary based on factors such as your account type and creditworthiness. Understanding these limits will help you plan your financial transactions effectively.

Question 4: Can loading Netspend with a credit card help me build credit?Yes, regularly loading Netspend with a credit card and paying off the balance on time can contribute to building a positive credit history. This demonstrates responsible credit behavior and can lead to improved credit scores over time.

Question 5: What security measures should I consider when loading Netspend with a credit card?Security is crucial when loading Netspend with a credit card. Use secure platforms and reputable providers that implement robust data protection measures and fraud prevention mechanisms. This helps safeguard your sensitive financial information and minimize the risk of unauthorized access.

Question 6: What are some tips for maximizing the benefits of loading Netspend with a credit card?To maximize the benefits, consider using a credit card that offers rewards or cash back on Netspend loading. Additionally, be aware of any fees associated with different loading methods and choose the most cost-effective option. Responsible credit card use, including timely payments and avoiding excessive debt, is also essential for maintaining good credit and managing your finances effectively.

Understanding these FAQs can help you make informed decisions when loading Netspend with a credit card, ensuring a secure and beneficial experience.

Transition to the next article section...

Tips for Loading Netspend with a Credit Card

Loading Netspend with a credit card offers convenience and potential benefits. Here are some tips to optimize your experience:

Tip 1: Compare Fees and LimitsDifferent loading methods may incur varying fees. Compare fees and limits associated with online, over-the-phone, and in-person loading to choose the most cost-effective option that aligns with your needs.

Tip 2: Consider Rewards and BenefitsSome credit cards offer rewards or cash back when used to load Netspend. Explore these options to maximize the benefits of loading your Netspend account.

Tip 3: Build Credit ResponsiblyRegularly loading Netspend with a credit card and paying off the balance on time can contribute to building a positive credit history. Use this opportunity to establish responsible credit behavior and improve your overall creditworthiness.

Tip 4: Prioritize SecurityProtect your sensitive financial information by using secure platforms and reputable providers for loading Netspend with a credit card. Verify the legitimacy of the platform and its security measures to safeguard your data.

Tip 5: Manage Debt EffectivelyWhile loading Netspend with a credit card can be convenient, it's crucial to manage your debt responsibly. Avoid excessive debt and make timely payments to maintain a good credit score and prevent financial strain.

By following these tips, you can effectively load Netspend with a credit card while maximizing the benefits and minimizing potential risks.

Transition to the article's conclusion...

Conclusion

In summary, loading Netspend with a credit card provides convenience and potential benefits. Understanding the associated fees, limits, rewards, and security measures is essential for an optimized experience. By comparing loading methods, considering rewards, building credit responsibly, prioritizing security, and managing debt effectively, individuals can harness the advantages of loading Netspend with a credit card while mitigating potential risks.

Ultimately, leveraging this method for adding funds to a Netspend account requires informed decision-making and responsible financial management. By adhering to the outlined tips and principles, individuals can effectively utilize this service to meet their financial needs and goals.

You Might Also Like

Quavo's Net Worth 2024 | The Rise Of A Hip Hop IconDiscover The Enticing Scope Of SinfulDeeds

The Ultimate Guide To Subhshree Sahu: Her Rise To Stardom

Discover "Ero Me Melsyu": A Fascinating Journey Into The World Of Japanese Erotica

Diana Hyland: A Legacy Remembered

Article Recommendations